Publications | Forms | Webinars and videos | eTaxBC help guide | Refunds | Audits | Appeals | FAQsĮTaxBC is the easiest and fastest way to file your return and pay your taxes. To learn more about the PST, such as what's exempt from PST or how PST applies to different types of businesses, refer to our resources: California sales tax applies to all purchases of tangible property from a California retailer or an out-of-state retailer engaged in. Generally, the rate of PST is 7% on the purchase or lease price of goods and services, with some exceptions. Report and pay the PST you collect and the PST you may owe on items you use in your business.Charge and collect PST at the time the tax is payable, unless a specific exemption applies.If your business is required to register, you must: for use in B.C., unless a specific exemption applies.įind out if your business is required to register to collect PST. provincial sales tax (PST) is a retail sales tax that applies when taxable goods or services are purchased, acquired or brought into B.C.

#SALESX TAX IN CA PROFESSIONAL#

Shopping in our retail stores, eating in our restaurants, and using professional services in the City – it all adds up to support for our community, our businesses, and our City services.The B.C. Those two figures combined would provide just about enough revenue to fund the nearly $106,000 in annual salary and benefits for one Sheriff's Deputy to patrol our streets. If families from the 21,000 households in Chino Hills enjoyed a $50 dinner at a Chino Hills restaurant once each week, the 1% sales tax returned to the City would amount to just over $42,000. It costs money to provide the services that Chino Hills residents expect Sales tax revenue is a significant source of funds that is used to pay for services. (Example: Tax accrued in January 20xx, is due February 20, 20xx.) Electronic payment information must be transmitted by 4:00 p.m. The returns and remittances are due on or before the 20th day of the month following the month during which the tax is accrued. Many families enjoy dinner at a restaurant about once each week. State Sales Tax Taxpayers Filing on a Monthly Basis.

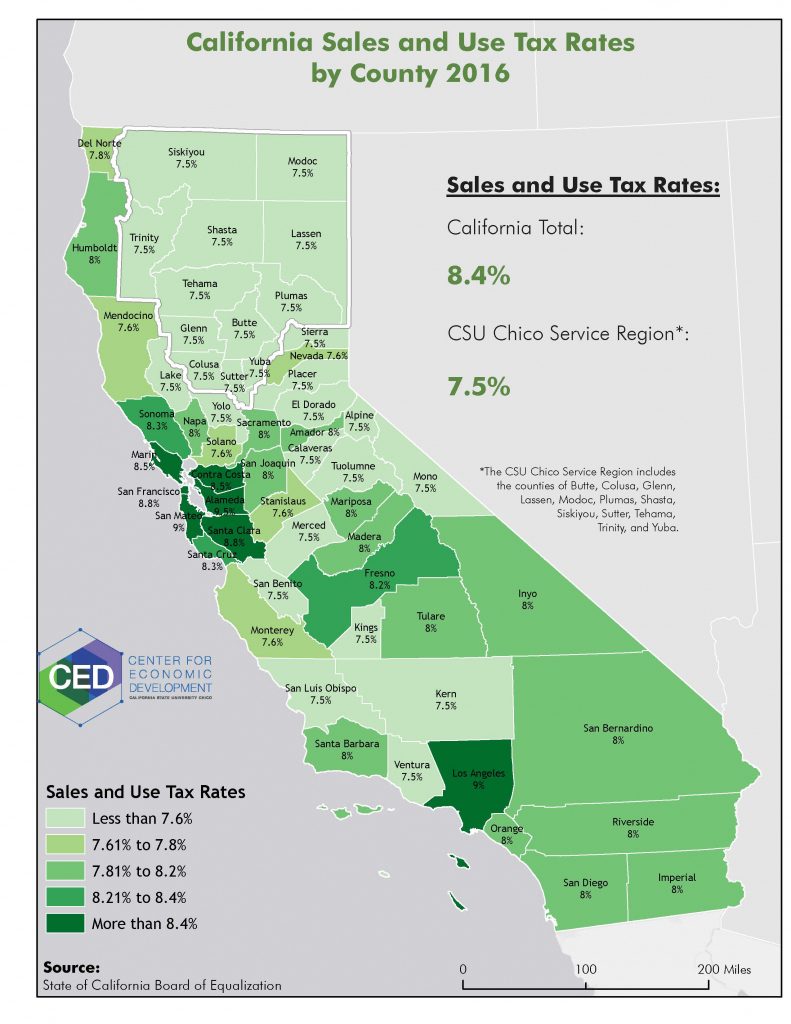

Support Our Local Businessesĭo not forget to support our local restaurants, too! Many restaurants in Chino Hills are owned by people who live in our City. If our 21,000 households drive about 30,000 cars that need a tank of gas each week – at $2 a gallon for a 25-gallon tank – we would have generated about $47,000 in sales tax revenue. When you buy gasoline and restaurant meals in Chino Hills that helps our City in the same way! We receive sales tax on gasoline purchases and a share of the State gas tax, which we can use to improve our roads. Money spent in our own community helps our businesses and restaurants thrive, and pay for the services everyone expects. If we spend our hard-earned dollars in our own community whenever we possibly can – it helps Chino Hills pay for services! Every dollar spent in another community helps that community pay for a police officer or fill a pothole. California sales tax rates vary depending on which county and city you’re in, which can make finding the right sales tax rate a headache. Find your California combined state and local tax rate. Some labor service and associated costs are subject to sales tax if they are involved in the creation or manufacturing of new personal property. Examples include furniture, giftware, toys, antiques and clothing. Since many cities and counties also enact their own sales taxes, however, the actual rate paid throughout much of the state will be even higher. That means that, regardless of where you are in the state, you will pay an additional 7.25 of the purchase price of any taxable good. The sales tax rate in our area is 7.75% and 1% of that amount is returned to the City and is used to pay for services. CA State Sales & Use Tax Pub 9 Construction and Building Contractors Pub 100 Shipping and Delivery Charges Pub 119 Sales Tax and Warranties Pub 1802 Place. Local tax rates in California range from 0.15 to 3, making the sales tax range in California 7.25 to 10.25. What is Taxable Retail sales of tangible items in California are generally subject to sales tax. California’s base sales tax is 7.25, highest in the country. It costs money to provide the services that Chino Hills residents expect! Sales tax revenue is a significant source of funds that is used to pay for services provided by the City of Chino Hills.

#SALESX TAX IN CA CODE#

Just enter the five-digit zip code of the location. From a tax terminology perspective, sales taxes are a proportional tax though because lower income earners may pay a greater percentage of their earnings to.

"Shop Chino Hills, First" and Help Fund City Services! The California Sales Tax Calculator is a powerful tool you can use to quickly calculate local and state sales tax for any location in California.

0 kommentar(er)

0 kommentar(er)